Managing the Financial Fallout of Your Holiday Spending

If you didn’t put money aside for Christmas spending this year, or you overspent your budget, you may be feeling a pinch right now. The holiday season is the time of year when most people spend more than they planned. And not just on their gift list. With so many great deals, many shoppers like to find some great gifts for themselves, too.

But now that the damage is done, how do you keep it from having a long-lasting effect on your finances? After all, maxing out your credit cards isn’t good for your bottom line (or your credit report). Here are some things to consider in order to get your finances back on track as you head into 2019:

Review Your Credit Cards

How much did you put on your credit cards? What is your debt ratio? (This is also known as your credit utilization ratio - it's the amount of debt you have compared to the amount of available credit.)

Missing a payment, keeping your balances too high, and maxing out your available credit can hurt your credit score. And fast! Paying down your credit cards quickly and putting your debt ratio back in balance can keep you from having any long-lasting effects to your credit score.

Review Your Savings and Emergency Fund

Did you use money from savings or your emergency fund to pay for gifts? If so, you may find yourself in some financial trouble if you need this money for unexpected, but necessary expenses like car or home repairs. You’ll want to rebuild these funds as quickly as possible to reduce your financial stress.

Review Your Budget

You’ll need to find extra money to pay down your credit cards, and then rebuild your savings. But if your income hasn’t increased, that money has to come from somewhere else.

That means it’s time to get serious about slashing unnecessary items from your budget. Even if it’s only temporarily while you get back on track. Cancel gym memberships, cable services, and slash your entertainment fund to repurpose that money to debt and savings. Start packing your lunches, making coffee at home, and fix budget-friendly dinners until your credit cards are paid off and your savings are replenished.

Yes, it will be hard, but it’s only for a short time and in the end, you’ll be glad you did it.

Earn Extra Income

You can get your finances back on track much faster if you start bringing in extra income and directing that money to paying off debt and building savings. Consider some part-time opportunities that you can do in your free time to earn extra cash. Get a part-time weekend job, drive for Uber or Lyft, start a dog-walking service, offer to rake leaves, shovel snow, or babysit. If you’re crafty, open an Etsy shop.

The opportunities for earning extra income are endless. As an added bonus, you may decide that you like the work and the income that goes with it even after you’ve paid off your debt.

Getting your finances in order as quickly as possible will ensure that there are no long-lasting effects to your overspending. Once you’ve reviewed your finances and made a plan for how to get them back in order, review your holiday spending. It’s time to start planning for next year so that you don’t find yourself in the same place again.

Article written by Emilie Burke. Emilie writes about overcoming debt, while balancing trying to eat healthy, stay fit, and have a little fun along the way. You can find more of her work at BurkeDoes.com.

Spent too much over the holidays? Here's how you can get your finances back on track this year. Union Plus Credit Counseling provides a free consumer credit counseling session, budget analysis and money management advice.

Cold Weather Pet Safety

Here are some tips to keep your pets safe during cold weather:

Winter wellness: Has your pet had his/her preventive care exam (wellness exam) yet? Cold weather may worsen some medical conditions such as arthritis. Your pet should be examined by a veterinarian at least once a year, and it's as good a time as any to get him/her checked out to make sure (s)he is ready and as healthy as possible for cold weather.

Know the limits: Just like people, pets' cold tolerance can vary from pet to pet based on their coat, body fat stores, activity level, and health. Be aware of your pet's tolerance for cold weather, and adjust accordingly. You will probably need to shorten your dog's walks in very cold weather to protect you both from weather-associated health risks. Arthritic and elderly pets may have more difficulty walking on snow and ice and may be more prone to slipping and falling. Long-haired or thick-coated dogs tend to be more cold-tolerant, but are still at risk in cold weather. Short-haired pets feel the cold faster because they have less protection, and short-legged pets may become cold faster because their bellies and bodies are more likely to come into contact with snow-covered ground. Pets with diabetes, heart disease, kidney disease, or hormonal imbalances (such as Cushing's disease) may have a harder time regulating their body temperature, and may be more susceptible to problems from temperature extremes. The same goes for very young and very old pets. If you need help determining your pet's temperature limits, consult your veterinarian.

Provide choices: Just like you, pets prefer comfortable sleeping places and may change their location based on their need for more or less warmth. Give them some safe options to allow them to vary their sleeping place to adjust to their needs.

Stay inside: Cats and dogs should be kept inside during cold weather. It's a common belief that dogs and cats are more resistant than people to cold weather because of their fur, but it's untrue. Like people, cats and dogs are susceptible to frostbite and hypothermia and should be kept inside. Longer-haired and thick-coated dog breeds, such as huskies and other dogs bred for colder climates, are more tolerant of cold weather; but no pet should be left outside for long periods in below-freezing weather.

Make some noise: A warm vehicle engine can be an appealing heat source for outdoor and feral cats, but it's deadly. Check underneath your car, bang on the hood, and honk the horn before starting the engine to encourage feline hitchhikers to abandon their roost under the hood.

Check the paws: Check your dog's paws frequently for signs of cold-weather injury or damage, such as cracked paw pads or bleeding. During a walk, a sudden lameness may be due to an injury or may be due to ice accumulation between his/her toes. You may be able to reduce the chance of iceball accumulation by clipping the hair between your dog's toes.

Play dress-up: If your dog has a short coat or seems bothered by the cold weather, consider a sweater or dog coat. Have several on hand, so you can use a dry sweater or coat each time your dog goes outside. Wet sweaters or coats can actually make your dog colder. Some pet owners also use booties to protect their dog's feet; if you choose to use them, make sure they fit properly.

Wipe down: During walks, your dog's feet, legs and belly may pick up deicers, antifreeze, or other chemicals that could be toxic. When you get back inside, wipe down (or wash) your pet's feet, legs and belly to remove these chemicals and reduce the risk that your dog will be poisoned after (s)he licks them off of his/her feet or fur. Consider using pet-safe deicers on your property to protect your pets and the others in your neighborhood.

Collar and chip: Many pets become lost in winter because snow and ice can hide recognizable scents that might normally help your pet find his/her way back home. Make sure your pet has a well-fitting collar with up-to-date identification and contact information. A microchip is a more permanent means of identification, but it's critical that you keep the registration up to date.

Stay home: Hot cars are a known threat to pets, but cold cars also pose significant risk to your pet's health. You're already familiar with how a car can rapidly cool down in cold weather; it becomes like a refrigerator, and can rapidly chill your pet. Pets that are young, old, ill, or thin are particularly susceptible to cold environments and should never be left in cold cars. Limit car travel to only that which is necessary, and don't leave your pet unattended in the vehicle.

Prevent poisoning: Clean up any antifreeze spills quickly, as even small amounts of antifreeze can be deadly. Make sure your pets don't have access to medication bottles, household chemicals, potentially toxic foods such as onions, xylitol (a sugar substitute) and chocolate.

Protect family: Odds are your pet will be spending more time inside during the winter, so it's a good time to make sure your house is properly pet-proofed. Use space heaters with caution around pets, because they can burn or they can be knocked over, potentially starting a fire. Check your furnace before the cold weather sets in to make sure it's working efficiently, and install carbon monoxide detectors to keep your entire family safe from harm. If you have a pet bird, make sure its cage is away from drafts.

Avoid ice: When walking your dog, stay away from frozen ponds, lakes and other water. You don't know if the ice will support your dog's weight, and if your dog breaks through the ice it could be deadly. And if this happens and you instinctively try to save your dog, both of your lives could be in jeopardy.

Provide shelter: We don't recommend keeping any pet outside for long periods of time, but if you are unable to keep your dog inside during cold weather, provide him/her with a warm, solid shelter against wind. Make sure that they have unlimited access to fresh, non-frozen water (by changing the water frequently or using a pet-safe, heated water bowl). The floor of the shelter should be off of the ground (to minimize heat loss into the ground) and the bedding should be thick, dry and changed regularly to provide a warm, dry environment. The door to the shelter should be positioned away from prevailing winds. Space heaters and heat lamps should be avoided because of the risk of burns or fire. Heated pet mats should also be used with caution because they are still capable of causing burns.

Recognize problems: If your pet is whining, shivering, seems anxious, slows down or stops moving, seems weak, or starts looking for warm places to burrow, get them back inside quickly because they are showing signs of hypothermia. Frostbite is harder to detect, and may not be fully recognized until a few days after the damage is done. If you suspect your pet has hypothermia or frostbite, consult your veterinarian immediately.

Be prepared: Cold weather also brings the risks of severe winter weather, blizzards and power outages. Prepare a disaster/emergency kit, and include your pet in your plans. Have enough food, water and medicine (including any prescription medications as well as heartworm and flea/tick preventives) on hand to get through at least 5 days.

Feed well: Keep your pet at a healthy weight throughout the winter. Some pet owners feel that a little extra weight gives their pet some extra protection from cold, but the health risks associated with that extra weight don't make it worth doing. Watch your pet's body condition and keep them in the healthy range. Outdoor pets will require more calories in the winter to generate enough body heat and energy to keep them warm – talk to your veterinarian about your pet's nutritional needs during cold weather.

You're probably already aware of the risks posed by warm weather and leaving pets in hot cars, but did you know that cold weather also poses serious threats to your pets' health?

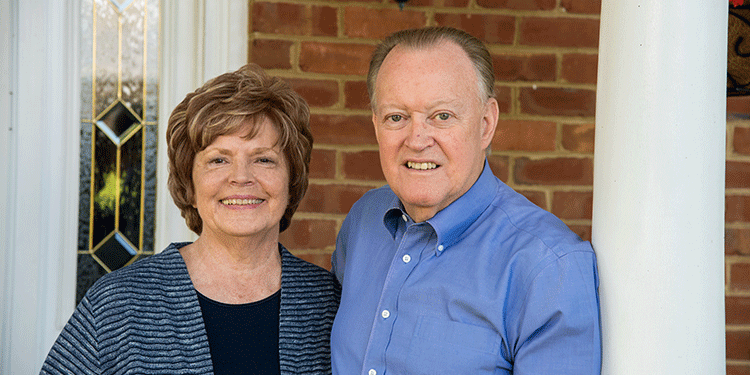

Retired AFM Member Takes Advantage of Union Plus Rebate

“The cost savings and the incentives that were provided through Union Plus made it an easy decision,” Williams, a member of AFM since 1967, says. “Our previous carrier gave us no incentives to stay with them and switching to AT&T allowed us to upgrade our phones.”

When Williams and other AFM members choose AT&T, they support more than 150,000 union members at the only nationwide unionized wireless carrier. In addition to rebates, Union Plus offers AFM members and retirees exclusive discounts on qualified AT&T wireless plans through the AT&T Signature Program.

Additionally, Union Plus Credit Cardholders may be eligible to receive a $100 rebate on an upgrade or purchase of a new smartphone, as well as up to a $150 rebate to help cover any cancellation fees or related costs when switching from another wireless provider.1

Since retiring from being a music teacher, Williams derives fulfillment from serving as the secretary treasurer for his AFM local in Lewisburg, West Virginia. He was thrilled to learn he was eligible for the AT&T smartphone rebate and said the promotion came along at exactly the right time, especially in a holiday season that stresses the wallets of most.

“It’s quite beneficial; every dollar is important,” he emphasizes. “I’m retired, and we live on a fixed income. Union Plus has always provided great opportunities to save and be thrifty. And I’m glad that Union Plus has the affiliation with a union-based wireless company in AT&T.”

“The process of obtaining the rebate was very easy,” Williams recalls. “We have been very happy with the service provided through AT&T.”

Williams says that being an AFM member is what made his career complete. He has been a Union Plus Credit Cardholder since its inception, and he regularly tells other AFM members about services provided through Union Plus.

“As soon as I learned of the Union Plus Credit Card and Union Plus’s partnerships with the unions, I took advantage of it,” he said. “Using the Union Plus card has been important for me.”

The Union Plus Credit Card2 program offers several card choices; whether you want rewards, a low intro APR for purchases, or an introductory rate for balance transfers, there is an option for you.

“As a union, we have quarterly meetings, and I always update them on services provided by Union Plus,” Williams said. “We have always expressed the benefits of being a Union Plus Credit Cardholder.”

Find the Union Plus Credit Card that is right for you at theunioncard.com.

To learn more about AT&T’s partnership with Union Plus, visit unionplus.org/att.

1You must be using the 15% AT&T Wireless Discount through Union Plus. You must use your Union Plus Credit Card when purchasing your new smartphone and data plan features. Your rebate will cover the costs of your qualifying smartphone upgrade and one month of the qualifying data plan services up to $100. You must be a Union Plus Credit Cardholder in good standing. You can only receive one AT&T smartphone and change of service rebate per union member per lifetime. Rebates are for union members only. You may need to submit further proof of your union membership upon request by Union Plus. Rebates are only available while funds last, so checks will be sent on a first-come, first-served basis.

2Credit approval required. Terms and conditions apply. See www.theunioncard.com for details. Union Plus Credit Cards are issued by Capital One, N.A. pursuant to a license from Mastercard International Incorporated.

When Gary Williams began shopping for new cell phones as holiday gifts for himself and his wife Dena last year, he quickly realized it was time to switch carriers. Williams is a retired member of American Federation of Musicians (AFM) Local 674 and a Union Plus Credit Cardholder, which gives him access to AT&T® discounts and benefits. When he learned about the AT&T smartphone rebate available to him, choosing AT&T was a no-brainer.

'Tis the Season of Wireless Savings

-

Get a $400 credit when you buy LG V40 ThinQ™1

And trade in an eligible smartphone.

Limited Time. Req's elig. service (min. $60/mo. before discounts). Value via instant credit or promo card (valid min. 90 days). $30 activation, other fees, & restr's apply. See offer details below. -

Save up to $80 on Ultimate Ears Wi-Fi speakers2

Ends 1/3/19. Req's apply. See $80 details below.

-

Get up to $60 in credits when you buy the Samsung Galaxy watch3

See Samsung Galaxy watch details below.

Plus, with the AT&T Signature Program, union members can deck the holidays with exclusive savings on wireless — making for a happy holiday indeed.

1$400 TRADE-IN OFFER: Limited Time Offer. Online and select locations only. Elig. Devices: Must buy a new LG V35/V40/G6 Duo. Elig. Service: Postpaid svc (voice & data) is req'd (min. $50/mo. for new svc with AutoPay and paperless bill discount. Pay $60/mo. until discount starts within 2 bills. Existing customers can add to elig. current plans which may be less). Elig. Trade-In: Trade-in must be in good working condition. Req's min. $20 trade-in value & meet AT&T Trade-In Program reqmts. Must trade in elig. smartphone at a participating location and complete trade-in within 14 days from the receipt of new phone. If new phone purchased between November 23, 2018 and December 18, 2018, trade-in may be completed on or prior to January 2, 2019. This is not an early upgrade program. If purchase at att.com, will get an email after purchase with promotion code necessary to use during online trade-in in order to get the promotional $400 value. Promo code must be used within 14 days, or if new phone purchased between November 23, 2018 and December 18, 2018, on or prior to January 2, 2019. Credit/Promotion Card: In AT&T-owned retail stores, you will receive an instant credit. For online trade-in, must use promotion code and will get a promotion card within 3 weeks after complete trade-in of an eligible device. The card is a Private Label AT&T Promotion Card ("Card") issued by MetaBank™ or CenterState Bank of Florida NA, via a license from Visa U.S.A. Inc. Instant credit & Card may only be used for AT&T products & svc in AT&T owned retail stores, at att.com, or to pay wireless bill. Card expiration date not less than 90 days from receipt. Dealers: Participating dealers provide savings for use at time of trade-in or a dealer promo card. Dealer cards contain add'l terms & conditions & may only be used at specified dealer. Other Obligations: Trade-in does not relieve obligations under AT&T Next or other AT&T Return and Exchange programs including recently-purchased device returns, Warranty, or Extended Warranty. Devices to be returned through these AT&T programs should not be traded in via this offer. Limit: One trade-in per qual. purchase. Visit a participating store or [att.com/tradein] to learn more.

GEN. WIRELESS SVC: Subj. to Wireless Customer Agmt (att.com/wca). Credit approval req'd. Deposit: may apply. Limits: Purch. & line limits apply. Activation/Upgrade: $30 Fee. Credit approval, taxes, fees, monthly, other charges, usage, speed, coverage & other restr's apply. See att.com/additionalcharges for details on fees & charges. Promotion, terms, & restr's subject to change & may be modified or terminated at any time without notice. International and domestic off-net data may be at 2G speeds. AT&T service is subject to AT&T network management policies. See att.com/broadbandinfo for details..

2Ends 1/3/19. Eligible Devices: UE BLAST ($70 discount), UE MEGABLAST ($80 discount). Not combinable with certain offers/discounts/credits. Return: within 14 days. Restocking fee: 10% of purch. price over $200. Limit 4 per customer. Subject to change. Restrictions apply.

3Get up to $60 in credits when you buy the Samsung Galaxy Watch

Must activate & maintain svc on eligible smartwatch (min. $10/mo.) and add to eligible wireless svc on compatible Android 5.0+ phone (min. $50/mo. for new service after AutoPay & Paperless billing discount that starts w/in 2 bills). Req’s AT&T NumberSync®.

*Limited time offer. Get up to two credits w/in 3 bills ($30/service + up to $30 activation). Taxes, other charges & restr’s apply. Messaging restr’s apply.

*Up to $60 Credit: Limited time offer. Must purchase eligible device/have eligible devices and activate with eligible service. Eligible Devices: Requires (i) new Samsung Galaxy Watch + Cellular purchase at full price or on installment agreement and (ii) Android 5.0 smartphone or newer with 1.5GB RAM or above. Eligible Service: Both Galaxy Watch and smartphone must be on same account with postpaid wireless voice & data services. (i) Galaxy Watch requires min. $10/mo. when added to eligible shared plan; (ii) Smartphone requires min. $50/mo. for new svc with autopay and paperless bill discounts. Pay $60/mo. until discounts start w/in 2 bills. Bill Credit: Account and service on your line must remain active 30 days to get up to two credits ($30 service + up to $30 activation) w/in 3 bills. No activation credit if already waived. Offer Limits: Max. of 1 activation credit/waiver per device. One service credit offer per eligible Samsung Galaxy Watch activation. May not be combinable with other offers, discounts, or credits. Device Limits: Galaxy Watch requires AT&T NumberSync to access the AT&T cellular network. For SMS/MMS messaging, the synced Smartphone must be on and connected to the AT&T network (via cellular or Wi-Fi connection; if using Wi-Fi connection, smartphone must have Wi-Fi calling activated). See www.att.com/numbersync for details. Usage charges apply. Activation/Upgrade: Up to $45 fee may apply. Return: w/in 14 days. Restocking fee up to $45. Other restrictions apply.

GEN. WIRELESS SVC: Subj. to Wireless Customer Agmt (att.com/wca). Deposit: May apply. Limits: Line limits apply. Prices may vary by location. Taxes, fees, monthly, other charges, usage, speed, coverage & other restr's apply. See att.com/additionalcharges for details on fees & charges. International and domestic off-net data may be at 2G speeds. AT&T service is subject to AT&T network management policies. See att.com/broadbandinfo for details.

Promotions, terms & restr’s subject to change & may be modified or terminated at any time without notice.

Looking for gift ideas this holiday season? AT&T has you covered with wireless deals to make shopping for everyone on your list a lot easier.

Union Plus Helps CSEA Mom Send Son to College

Susan Portener’s son, Andrew, has always worked hard and been a high achiever. When Andrew told his mom that he wanted to go to college at the University of California, Los Angeles, she knew she would do everything she could to send him there.

An educator since 1982, Portener has been an active member of the California School Employees Association (CSEA) for the past 15 years. She first learned about the Union Plus Scholarship Program when Andrew brought home his college application materials. He applied and earned a $1,000 competitive Union Plus scholarship.

“It helped a great deal,” recalls Portener, who works as a special education paraeducator at the James Madison Elementary School in Indio, California. “Along with a scholarship from our chapter (CSEA Desert Sands Chapter 106), it went toward his first quarter tuition.”

The Union Plus Scholarship Program is offered through the Union Plus Education Foundation. Since 1991, the program has awarded more than $4.3 million to students of working families – more than 2,900 union families have benefited from the program. Current and retired members of CSEA, as well as spouses and dependent children, are eligible to apply.

For Portener, the scholarship Andrew earned through Union Plus was another in a long list of reasons that she values being a member of CSEA.

Learn more about the Union Plus

Scholarship Program

CSEA member Susan Portener encouraged her son to apply for the Union Plus scholarship after learning that he wanted to go to college. Her son, Andrew, earned a $1000 scholarship which he applied to his first semester tuition.

Labor Leader Turns to Union Plus Mortgage Company

In 2010, local union organizer Tefere Gebre and his wife Jennifer joined the millions of working families underwater as their San Diego home lost most of its value during the national mortgage crisis.

A few years after short selling their home and moving into a rental, Gebre and his wife relocated to the east coast when he earned a national leadership role as the AFL-CIO’s Executive Vice President.

They were able to buy a new home in Silver Spring, Maryland, but were saddled with a high interest rate mortgage.

“As soon as I joined the Union Plus board, we saw the opportunity to build a great mortgage program for union members and their families,” Gebre recalls.

The Union Plus Mortgage Company (UPMC), founded in 2016 by the AFL-CIO, is designed so that the labor movement gains as UPMC grows and prospers. Union members and their families are eligible to apply for financing through UPMC, which is union-owned and staffed by unionized loan officers.

“Refinancing with UPMC was so simple and hassle-free,” Gebre shares. “Our refinanced mortgage saves us more than $600 per month.”

The Union Plus Mortgage Program, with financing available through Union Plus Mortgage Company, is available for all eligible union members.

Qualifying members are eligible for special benefits for first-time homebuyers as well as:

- A $500 gift card after closing for purchasing or refinancing a home

- Special hardship mortgage assistance from Union Plus in the event of income loss due to disability, unemployment or strike/lockout

- Veterans of the Armed Services are eligible to apply for a one-time $1000 Union Plus Veterans Grant

For more information, visit unionplusmortgage.com or call 855 UNION 53 (855-864-6653).

The AFL-CIO, Union Privilege and a group of unions own Union Plus Mortgage Company and will benefit if you get your loan through the company. However, you are not required to use Union Plus Mortgage for your loan and are free to shop. For your Affiliated Business Arrangement Disclosure Statement, please visit www.unionplusmortgage.com.

Union Plus Mortgage Company has a services agreement with Union Privilege in which Union Privilege receives a financial benefit for providing agreed upon services.

AFL-CIO Executive Vice President Tefere Gebre used the Union Plus Mortgage Company to refinance a high interest mortgage on his new home. The Union Plus Mortgage Program, with financing available through Union Plus Mortgage Company, is available for all eligible union members.

Eight Ways to Help Your Neighborhood

Tired of looking at unkempt foreclosures in your area? Learn how to save your block without putting yourself or your property at risk.

An empty home has more issues than poor curb appeal. Kids may go exploring in and around these homes, risking injury. And as time passes, the properties also can attract wild animals and/or vandals — putting the whole neighborhood at risk.

"Virtually every city in America is touched by this problem," says Daniel Kildee, president of the Center for Community Progress, a nonprofit that partners with local governments to address abandoned property issues.

Things Homeowners Can Do

- Work With Your Neighborhood Organization

A collective voice, like that of a neighborhood organization, is louder and more effective than a single one, especially when it’s asking a local government or mortgage company to take action. “Neighborhood organizations promote a sense of community and get people talking to each other about what’s going on in the neighborhood,” says Kildee.

The neighborhood crime watch concept is one model of a group focused on monitoring and maintaining vacant properties. Learn more about watch programs from the National Neighborhood Watch program.

- Notice the Warning Signs

- Neighbors are often the first to notice the subtle signs of a vacancy, such as:

- Piles of mail and fliers

- Overgrown grass and landscaping

- Odd or unpleasant odors

- Graffiti

- Animals living under porches

- Strangers hanging around

- “It’s not a bad thing for neighbors to be nosy about these things,” says Kildee. “It’s going to have a negative effect on everyone if something isn’t done.”

- Be Diligent About Protecting Your Home

Neglected properties attract crime and are fire hazards. According to the U.S. Fire Administration, 7% of residential fires are in vacant buildings. Protect your own home by keeping doors and vehicles locked, installing motion lights and making sure smoke alarms are in working order.

- Determine the Owner of Record

To ensure property maintenance, contact the person or agency responsible for the vacant home. If the property is up for sale, identify the owner or the real estate agent. Or, if it’s in foreclosure, call the mortgage company that holds the title.

The city or county recorder or assessor will have records of property ownership. “It is important to identify vacant properties as soon as possible so they can be monitored,” says Kildee. “Sometimes the owner is going to be more vigilant if they know somebody is paying attention.

- Call the Authorities

If you see anything that seems suspicious or potentially dangerous, call the police. “Pay attention, and don’t be afraid to act,” says Kildee.

- Know the Local Regulations

Cities have public nuisance regulations and laws addressing property maintenance. Some require owners to register their vacant properties and pay an annual fee that can range from a few hundred to several thousand dollars. The fees help cover any government costs to care for a property, while encouraging the owner to rehabilitate or sell the property.

“You’d think an empty building would require less public service, but it’s the opposite,” says Kildee. “Police and fire departments, as well as building code inspectors, are regularly called to vacant properties.” Brush up on local laws through your local government’s website or your elected city representative.

- Do it Yourself … But Only as a Last Resort

If a property owner or city won’t address maintenance issues such as mowing the lawn or clearing snow, your neighborhood organization may need to. “Do what you can through the owner or local government, but don’t wait for something bad to happen,” says Kildee.

However, don’t take action until you have exhausted efforts to get the owner of record or the city to respond. Getting written permission from the owner is one way to protect yourself. “In extreme cases, some communities allow you to go to court to be appointed receiver of property just for maintenance,” says Kildee.

Union Plus offers special discounts on auto insurance from MetLife Auto & Home®.

Learn more about

Union Plus Auto and Home Insurance

Homeowners can take steps to combat reduced property values due to unkempt foreclosures. Protect your neighborhood by being proactive and vigilant.

Planning for a Caregiver

While a sensitive topic, planning allows everyone involved to define the caregiving arrangement that works best for them, helping to reduce any undue stress or burden. Whether it’s you or a loved one planning for a caregiver, it’s helpful to understand different types of caregiving relationships, what caregivers can do, when one might be needed, and how to choose a caregiver.

Ready to Learn More?

Watch our Planning for a Caregiver module. It's quick and easy. Simply click the yellow button at the bottom of this page. The module will start playing as soon as you arrive on the site. Once you've listened to the introduction, click the arrow to the right of the screen to move through the three different topics:

- What is a caregiver?

- When will you need one?

- What are the characteristics of an ideal caregiver?

Tips

Once you've started the module, you can see captions, adjust volume and pause the module by using the controls at the top right of the screen. You can also select the transcript button to see all of the content from the module.

According to a recent poll, nearly one in six Americans act as a caregiver for an older family member or loved one. Caregivers provide crucial support in important areas of daily life to individuals who are impaired or aging. Planning for future care is important and necessary.

Don’t Let Vet Bills Haunt Your Halloween

Including pets in holiday festivities is becoming the norm as pet ownership rises, and Halloween is no exception. But beware of potential hazards this time of year may bring such as Halloween candy and costumes as they present opportunities for pets to enjoy non-traditional “treats” that could lead to unexpected vet bills.

Over the last three years, claims for pets ingesting toxic foods or foreign objects consistently ranked among the top 10 accident claims during the month of October. Accident claims due to toxic foods or foreign object ingestion increased 5% in October 2017 compared to the prior year, representing 19% of all accident claims during the month*.

Help reduce your pet’s risk by taking proper precautions this Halloween season:

- Keep Halloween treats away from pets. While chocolate is one of the most toxic to dogs and cats, candy containing xylitol, grapes, and raisins should also be kept out of reach. Make sure wrappers find their way into the trash, as these also present a risk to pets if ingested.

- If dressing your pet up in a Halloween costume this year, be sure to inspect the costume for any small or loose pieces that might be easily chewed off and swallowed. Beware of these hazards on human costumes as well.

- Keep seasonal Halloween décor, like lights and candles, in out of reach areas for pets. Pets may want to play or chew on smaller objects or loose items, resulting in a potential choking hazard.

If you know or suspect your pet has ingested a toxic food or foreign object, it is important to seek veterinary care as soon as possible. Unexpected veterinary costs can be scary but having pet insurance can help take the fright out of those expensive veterinary bills.

Accident plans are only $6/month for cats and $9/month for dogs (pricing varies in Washington). If you’d like to include illness coverage, there are comprehensive BestBenefit Accident and Illness plans available.

Learn more about

Union Plus Pet Insurance

*Based on Pets Best claims data from 2015, 2016, and 2017

Pet insurance offered and administered by Pets Best Insurance Services, LLC is underwritten by American Pet Insurance Company (APIC) or Independence American Insurance Company (IAIC). Please visit www.americanpetinsurance.com to review all available pet health insurance products underwritten by APIC.”

Halloween is fun for pets too, take these precautions to keep your pet healthy and safe this year. Union Plus Pet Health Insurance reimburses cat and dog owners for veterinary expenses when their pets get injured.

Free College Program Helps Single Mom Achieve Lifelong Dream

Since grade school, Lorraine Llauger has had her heart set on earning a college degree. But until recently it looked like she’d never achieve her dream.

Llauger, of Kissimmee, Florida, is a journeyman electrician and a member of the International Brotherhood of Electrical Workers (IBEW) Local 606 in Orlando. She is also a single mom raising two children on her own.

“I never thought I’d be going to college. I thought, where am I going to find the time? I can’t go off to a campus,” she reflects.

One day, her coworker mentioned the Union Plus Free College Program. Within weeks, Llauger was registered and taking classes online.

The Union Plus Free College Program partners with AFSCME and Eastern Gateway Community College to offer online courses and degree programs with no out of pocket cost to active or retired union members and their eligible family members, including spouses and children.

Llauger is now working towards an associate degree in Business Management, at her own convenience.

“My favorite thing is that I can be anywhere where there is internet,” Llauger enthuses. “For Union Plus to provide an online course, free, that’s amazing.”

Of her future plans, Llauger says, “More doors will open. I’m a single parent, so it’s even more exciting that I can advance myself with this program.”

Llauger has a message for other union members: “I definitely recommend the Union Plus Free College program. A lot of people entering the trades never thought they could make it to college. Getting this opportunity makes everything so much simpler.”

Visit www.unionplusfreecollege.org or call 888-590-9009.

Lorraine Llauger is a journeyman electrician and a member of the International Brotherhood of Electrical Workers (IBEW) in Orlando, Florida. Llauger hoped to earn a college degree, but did not know how she'd be able to fit college in with her busy life as an electrician and a mother. A coworker mentioned the Union Plus Free College Program, and within weeks, Llauger was registered and taking classes online.