Common Mistakes Made When Selling A Home

If you’re about to go down the road of selling your home, you’ve probably heard that it’s not for the faint of heart. Especially in a buyer’s market or during the winter months — patience, creativity and persistence will be essential tools you’ll need in order to find the right buyer.

Avoid some common mistakes by checking out this list.

Know Your Market

If you decide to go “For Sale By Owner” (FSBO) — you’ll need to educate yourself on your market. The best way to do this is to subscribe to sites like Trulia and Zillow by creating profiles and then saving a search for comparable homes for sale in your area. These sites will send you any new listings that become available in your area. You should also search for homes recently sold that are comparable to your home — this will help you to gauge where your home should be priced. Look at trend reports for your area to get a sense for your market — are homes selling? Where are they selling? When are they selling? And, at what price point? You’ll notice that in some areas certain neighborhoods, price points or types of homes might be selling quicker than others. Look for these trends so that you can better position your home when you list it.

Not Getting on the MLS

Whether you’re FSBO or using a realtor, getting your home on the MLS is extremely important. Adding your listing to ancillary sites like Zillow or Trulia is also a good idea — but, typically your real estate agent will manage this for you. If you are FSBO, be sure to look at MLS listing options that include other site listings in the purchase price. Once your listings are added — be sure you have ownership over it. Log into these accounts and update your listings to include as much media (pictures/videos) and information as you can. The more the better! And, if you decide to change your price, make sure to update all sites.

Not Even Considering a Real Estate Agent

If you’re looking at the dollars and cents, you might be apprehensive about hiring a real estate agent. But, before you make a final decision consider this:

- You will most likely have to pay for the buying agent out of pocket, so your listing agent would (typically) only be a 3% commission on the sales price.

- Calculate 3% of your home price and think about the hours it might take away from your work or home life to market and show your home.

- If you don’t have a real estate agent, you might need to pay for a lawyer to double check your contracts (which will cost some money).

- Agents have access to numerous marketing tools and sites, not available to the public

If you’re ready to sell or purchase a home, check out the Union Plus Real Estate Rewards program. You could get $500 for every $100,000 in home value if you use a real estate agent approved by SIRVA.*

*To qualify for cash back rewards (in cash back states), you must use a SIRVA-referred real estate agent. Program designed as a referral service to provide you the opportunity to select a real estate agent to meet your needs. You must evaluate the brokers, agents and their services and make selections and decisions based upon your best judgment, interest, priorities and concerns. Call 800-284-9756 or visit www.up-RealEstateRewards.com for important program details and state restrictions. Union Plus makes member feedback available. Union Plus does not endorse any User Content, or any opinion, recommendation, or advice expressed herein.

SIRVA is an independent provider of services. Union Plus is not affiliated with SIRVA and does not manage SIRVA or its programs. SIRVA is paying Union Plus for advertising services including dissemination of information about SIRVA and its programs to participating unions and their members as well as participation in Union Plus events and programs. No referral, recommendation, service representation or exclusivity requirement is intended by the Union Plus's mention or dissemination of the SIRVA name and delivery of this information to participating union members.

Your home is likely one of your most valuable assets, so avoid these common mistakes when selling your home. Avoiding these mistakes may help you save both time and money on the sale.

Retired USW Member Discovers Union Plus Mortgage Veteran’s Grant

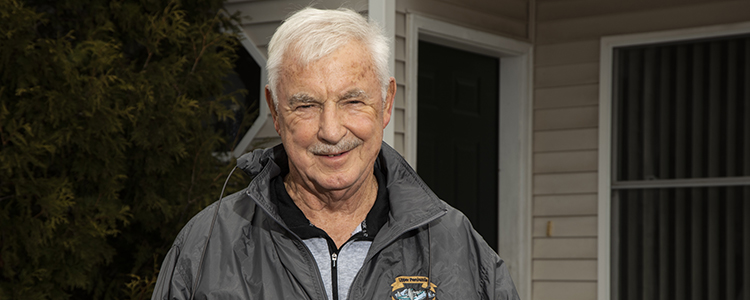

Retired United Steelworkers (USW) District 2 member Jim Blank served in the U.S. Army from 1961 to 1964, and was based in Frankfurt, Germany.

“It was a good responsibility,” recalls Blank, who lives in his hometown of Munising, Michigan, a small town in the state’s Upper Peninsula. “It was satisfying serving my country.”

Upon honorable discharge, Blank moved to Lansing, Michigan to work on the assembly line at a motor wheel factory. However, Blank soon wanted to move back home, so he took a position with the Kimberly-Clark paper mill in Munising.

“It was a great job over the years,” says Blank. “We had great benefits. The USW did a great job for us. After 30 years, I decided to retire.”

Blank didn’t learn about Union Plus until his daughter asked for his help in getting a mortgage: she wanted to use his USW membership to apply for a Union Plus Mortgage through Wells Fargo Home Mortgage.

“The representative at Wells Fargo saw that I was a retired union member and a veteran and suggested that I apply for the Union Plus Mortgage Veteran’s Grant1.,” remembers Blank. “Sure enough, I got a check in the mail.”

If you have served in the military and are an active or retired member of a union and you have financed your primary residence through the Union Plus Mortgage Program, you may qualify for the Veteran’s Grant. It provides a one-time grant of up to $1,000 to offset the cost of the home.

“I can’t believe I learned about Union Plus so late,” says Blank. “If you’re a veteran, you should definitely look into the Veteran’s Grant.”

To learn more about the Union Plus Mortgage Program and the Veteran’s Grant, please visit unionplus.org/mortgage.

1.The Union Plus® Mortgage Assistance Program and Veteran’s Grant are provided and administered through the AFL-CIO Mutual Benefit Plan (“The Plan”), which is not affiliated with Wells Fargo Bank, N.A. Additional information about this program and eligibility criteria can be obtained at unionplus.org/assistance.

Wells Fargo Home Mortgage has a services agreement with Union Privilege in which Union Privilege receives a financial benefit for providing agreed-upon services. Wells Fargo Home Mortgage encourages you to shop around to ensure you receive the services and loan terms that fit your home financing needs

Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A. © 2019 Wells Fargo Bank, N.A. All rights reserved. NMLSR ID 399801. Equal Housing Lender.

When retired USW member and Army veteran Jim Blank discovered Union Plus recently, he was pleasantly surprised to learn he could still benefit from its programs. He received a $1,000 Veteran’s Grant when he purchased a house for his daughter through the Union Plus Mortgage Program.

Understanding the Home Loan Process for Union Families

A new home for your growing family. A three car garage. Downsizing. Whatever your reason for buying or refinancing your first or next home, the Union Plus® Mortgage program with financing provided by Wells Fargo Home Mortgage is ready to help. The program delivers special home financing benefits that union members, their spouse (or domestic partner), parents, and children can take advantage of.

And when you choose Wells Fargo, there's a better way to get a mortgage. You've got a team and a guide, a home mortgage consultant, who will take you all the way to closing.

We even give you a simplified way to manage the process. yourLoanTrackerSM lets you upload documents, get status updates and receive and sign important disclosures ... all online1. From any computer, smartphone, or tablet, you'll see what's going on with your loan in real time. It's available for most loans, and you'll get access through your home mortgage consultant if yours is eligible. That's how we make the home loan process easier, your team and yourLoanTracker.

There are 4 main steps in the mortgage process, and the first is to Complete Your Application.

Start by connecting with a home mortgage consultant, who will help you understand and compare your loan options. Wells Fargo's exclusive PriorityBuyer® preapproval letter gives you an estimate of how much you can borrow and a price range you're comfortable with. When you've found the right house, your home mortgage consultant will help you finish your application.

YourLoanTracker makes the next part a breeze. You'll have disclosures in minutes instead of waiting days to get them by mail. Right away you'll be able to see the terms and fees of your loan. Plus, you can send us supporting documents electronically: pay stubs, W2s, bank statements. Simply upload or take a picture, and it's all secure.

This brings us to Step 2, the Financial and Property Review. Your home loan processor and the rest of your team will look over your supporting documents to verify your application. If we need anything else from you, we'll let you know right away. We'll also order an independent appraisal to make sure the property value backs up the purchase price. Then, we send everything to the home loan underwriter.

Use yourLoanTracker to stay plugged into the process or see if there's anything you need to follow up on.

When everything's complete and you're approved, you'll get your final commitment letter from us, and be ready for step 3: Preparing to Close.

You're almost there ... just a few more things to take care of.

You'll need homeowners insurance, so be sure to check with your insurance company. We'll review your property title to make sure it's correct and schedule your closing date. At least three days before you close, check yourLoanTracker for your closing disclosure. You'll sign this later, so look it over carefully. It will tell you things like your final interest rate, monthly payment, and how much money you may need to bring to your closing. Your home mortgage consultant is available to answer any questions.

Now you're ready for step 4: Closing!

There will be three main players at your closing: you, your settlement agent, and a whole lot of documents. No worries, though; you've seen some of these in yourLoanTracker. And your settlement agent is there to walk you through them. When all the paperwork is done and you've paid any closing costs, you'll get your keys.

And after closing on a loan through the Union Plus Mortgage program, you’ll be eligible for special benefits that include receiving a My Mortgage GiftSM award from Wells Fargo - $500 for buying a home or $300 for refinancing your home – for use at participating retailers and access to mortgage assistance through Union Plus in times of hardship such as layoff, disability or strike.3 Additionally, qualifying union member veterans can also complete an application with Union Plus to receive a $1,000 Mortgage Veteran’s Grant4 within 90 days of closing on a new primary home purchase through the program. Terms and restrictions may apply.

All credit decisions subject to credit qualification.

1. To determine if your home loan is available with yourLoanTrackerSM features, talk to your home mortgage consultant.

2. Eligible individuals can receive the Wells Fargo My Mortgage GiftSM award approximately 6 weeks after closing on a new purchase or refinance loan secured by an eligible first mortgage or deed of trust with Wells Fargo Home Mortgage (“New Loan”), subject to qualification, approval, and closing, when identifying themselves as eligible. The My Mortgage Gift award is not available with The Relocation Mortgage Program® or to any Wells Fargo team member. Only one My Mortgage Gift award is permitted per eligible New Loan. This award cannot be combined with any other award, discount, or rebate, except for yourFirst Mortgage® and the Mortgage Thank You Gift. This award is void where prohibited, transferable, and subject to change or cancellation with no prior notice. Awards may constitute taxable income. Federal, state, and local taxes, and any use of the award not otherwise specified in the Terms and Conditions (also provided at receipt of award) are the sole responsibility of the My Mortgage Gift recipient.

3. The Union Plus® Mortgage Assistance Program and Veteran’s Grant are provided and administered through the AFL-CIO Mutual Benefit Plan (“The Plan”), which is not affiliated with Wells Fargo Bank, N.A. Additional information about this program and eligibility criteria can be obtained at unionplus.org/assistance.

4. Terms and restrictions apply. Grants valued at $600 or more may be considered taxable income by the Internal Revenue Service. Therefore, a Form 1099-MISC tax reporting form will be issued by Union Plus to each recipient of a grant valued at $600 or more.

Union Plus® is a registered trademark of Union Privilege.

Wells Fargo Home Mortgage has a services agreement with Union Privilege in which Union Privilege receives a financial benefit for providing agreed-upon services. Wells Fargo Home Mortgage encourages you to shop around to ensure you receive the services and loan terms that fit your home financing needs.

Information is accurate as of date of distribution. Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A. © 2019 Wells Fargo Bank, N.A. All rights reserved. NMLSR ID 399801

![]()

Buy your new home with confidence. The Union Plus Mortgage program provides union families with exclusive benefits and assistance along every step of the homebuying process.

How to Make Your Move Easier for Your Family

Say goodbye to a much-loved home and settle in quickly to a new place with these tips for transitioning.

How to Say Goodbye to Your Old Home

Take photos of it. Before everything is swept up into moving boxes, take photos of your home. Document each room, so you can revisit it later. If you have children, snap pictures of them, too, enjoying the house as usual: drawing at the kitchen table, playing in the garden, chilling in front of the TV.

Snap it messy! Take pictures of your home on a typical day, when it’s not clean and tidy. This will provide a more meaningful record of your house and how you used it. You could arrange all these images in an album, with the address and the dates you lived there on the front.

Leave your mark. Why not leave a little something of yourself behind before you move out? No, that does not mean a sink full of unwashed coffee mugs! Try something subtler. You could go for the classic time capsule, hidden in the attic. Or write a letter to the new owners, welcoming them to the house and explaining what you loved about it.

Hold a goodbye party. Celebrate your home and the life it has given you with a goodbye party. It doesn’t matter if you’ve already started to pack — your guests can happily negotiate a few boxes. String up some lights, play some music and enjoy the house with the family and friends you’ve shared it with over the years. Don’t forget to raise a glass to your new home.

How to Settle Into Your New Home

Clean up. When you arrive in a new home, nothing looks, feels or even smells the same way, which can be unsettling. So start by cleaning surfaces, floors and inside cupboards with some familiar, fresh-scented products to help make the place feel like yours.

Get fresh. Fling open the windows on the first day, too, to air out the rooms and freshen up the whole house. In the evening, light a few scented candles.

Grab a few goodies. Piles of moving boxes and empty rooms do not help a house feel like a home, so treat yourself and your new place to a few goodies that will make it feel special. Arrange some fresh flowers, bought at the store on the way to the house or picked from the garden, or buy quality hand soap or a few new towels.

Don’t forget the pets! Dogs and cats may also take a while to settle into a new home, so try to ease the transition for them, too. When you arrive at your new home, shut the cat in a single room for safety, with water, the litter tray and its bed. You can let your cat out at the end of the day to explore, but confine it to a few rooms so it doesn’t feel overwhelmed. Cats should be kept inside the house for a week or so to prevent them from trying to return to your old home.

Do right by your dog. You should introduce your dog to the new house. Keep your dog on a leash and take it around the key rooms, one at a time, allowing it to sniff and explore, but under your supervision. Point out where its bed is and even keep upper floors out of bounds at first, so it doesn’t feel overwhelmed by its new territory.

Personalize the place. Paint a wall, hang photos or buy some new blinds. Even if the rest of the redecorating will take months, a few small tweaks can really help you start to stamp your personality on your new home.

Host a housewarming. Sharing your new home with family and friends can help you bond with it, so host a party — no gifts required. You might like to invite new neighbors, too, as a good chance to get to know them, or simply keep it small and intimate.

Ready to sell or buy a home? Check out the Union Plus Real Estate Rewards program. You could get $500 for every $100,000 in home value if you use a real estate agent approved by SIRVA to sell or buy a home.*

*To qualify for cash back rewards (in cash back states), you must use a SIRVA-referred real estate agent. Program designed as a referral service to provide you the opportunity to select a real estate agent to meet your needs. You must evaluate the brokers, agents and their services and make selections and decisions based upon your best judgment, interest, priorities and concerns. Call 800-284-9756 or visit www.up-RealEstateRewards.com for important program details and state restrictions. Union Plus makes member feedback available. Union Plus does not endorse any User Content, or any opinion, recommendation, or advice expressed herein.

SIRVA is an independent provider of services. Union Plus is not affiliated with SIRVA and does not manage SIRVA or its programs. SIRVA is paying Union Plus for advertising services including dissemination of information about SIRVA and its programs to participating unions and their members as well as participation in Union Plus events and programs. No referral, recommendation, service representation or exclusivity requirement is intended by the Union Plus's mention or dissemination of the SIRVA name and delivery of this information to participating union members.

Reminisce about your wonderful times in your old home while settling in to your new home with these easy tips. Union members can get cash back when buying or selling a home with the Union Plus Real Estate Rewards program.

2019 Union Plus Scholarships Award $170,000 to Union Members and Families

Washington, D.C. – Union Plus recently awarded $170,000 in scholarships to 108 students representing 34 unions. This year’s group of scholarship recipients includes university, college and trade or technical school students from 31 states plus the District of Columbia.

The Union Plus Scholarship Program, now in its 28th year, awards scholarships based on outstanding academic achievement, personal character, financial need and commitment to organized labor's values. The program is offered through the Union Plus Education Foundation, supported in part by contributions from the provider of the Union Plus Credit Cards. Applicants do not need to be a credit cardholder to apply for the scholarship.

"When I see the dedication that these scholarship recipients display, I know the future of the labor movement is strong,” said AFL-CIO President and Union Plus Board Chairman Richard Trumka. “I'm so proud that the Union Plus Scholarship Program enables deserving students to pursue diverse educational opportunities and has helped 3,000 union members and their families achieve their dreams of a higher education.”

Since starting the program in 1991, Union Plus has awarded more than $4.5 million in educational funding to more than 3,000 union members, spouses and dependent children. Union Plus Scholarship awards are granted to students attending a two-year college, four-year college, graduate school or a recognized technical or trade school. The selection process is very competitive and this year over 7,100 applications were received from 65 unions, all 50 states, plus the District of Columbia and two U.S. territories, representing an almost 20% increase in applications over 2018. Visit unionplus.org/scholarship for applications and information about benefit eligibility.

“The entire team here at Union Plus is so proud to be able to offer this scholarship program to help union family members offset the high cost of college education” said Mitch Stevens, President of Union Plus. “This year’s group of 108 winners are all incredibly talented, motivated, and deserving students taking an important step to further their education and build the foundation for future success.”

In addition to the scholarship program, Union Plus offers the Free College Program in partnership with AFSCME, which makes it possible for union members and their families to earn an associate degree completely online at no cost. Union Plus also provides a wide range of money-saving programs including discounts on wireless services from AT&T, the only nationwide unionized wireless carrier, significant savings at six national car rental companies, special offers for travel and recreation, and more. Union Plus also offers a Credit Card Program1 and Mortgage Program, both of which feature Hardship Assistance Grants2 for eligible participants. Visit unionplus.org to learn more.

Visit unionplus.org/scholarship to apply for the 2020 Union Plus Scholarship.

About Union Plus

Union Plus, founded by the AFL-CIO in 1986, uses the collective buying power of America’s 12.5 million union members to deliver top-quality benefits and services at competitive prices to working families. Union Plus offers a wide range of programs, including credit cards, home mortgages, discounts on wireless service from AT&T, insurance protection, and travel, recreation and entertainment discounts. To learn more, visit unionplus.org.

1Credit approval required. Terms and conditions apply. See www.theunioncard.com for details. Union Plus Credit Cards are issued by Capital One, N.A. pursuant to a license from Mastercard International Incorporated.

2Certain restrictions, limitations and qualifications apply to these grants. Additional information and eligibility criteria scan be obtained at UnionPlus.org/Assistance.

The Union Plus Scholarship Program recently awarded $170,000 to 108 students who represent 34 unions. Union members and their dependents attending university, college and trade or technical school are eligible to apply for a Union Plus scholarship.

Union Plus Launches New Online Store

Show your union pride.

Introducing the new Union Plus store—featuring 100% union made merchandise. “We are excited to launch the new Union Plus store which features union made items, so everyone can show their union pride and support union workers at the same time,” says Mitch Stevens, president of Union Plus.

Even the designs are union made. Each of the three designs appeal to both union members and people who support the union movement. A 2018 Pew Research Study shows a majority of people hold a favorable view of unions so anyone who wants to support unions can turn to Union Plus to show their union pride.

For now, product selection is limited to t-shirts, baseball caps, zip hoodies, lunch coolers, tumblers and buttons. If the program flourishes, other products and designs will follow. Shipping is handled by the United States Post Office. Products are printed and distributed by K&R industries which is represented by IUPAT Local 1937.

Best of all, union members registered with Union Plus will receive discount coupons through periodic emails from Union Plus. People who wish to receive these emails need to establish an account on the Union Plus website. (unionplus.org)

Here’s your chance to show your Union Pride. Union Plus now has an online store that features three great designs and a variety of items. Check it out at www.shopunionplus.org.

How Millennials Buyers are Different Than Baby Boomers

When selling your home, it’s important to think about your prospective buyers and how you should market differently to each group. Even if you think your home would be better suited for a baby boomer or retiree, you might be surprised to find out your home could be attractive to a single Millennial. Here’s how your Millennial marketing plan might need to be updated.

Highlight Certain Features

Millennials are looking for features that are a little different than baby boomers. For instance, they are looking for:

- Open floor plans

- Ranch style homes

- Media rooms

- Hardwood or tile floors

Where as baby boomers might be looking things like:

- Two-car garages

- Storage

- Large kitchens

If you have these types of features in your home, you should be sure to play them up in your marketing for each group.

Location, Location, Location

Your neighborhood is also really important because Millennials care about convenience. They are looking for a location that offers them easy access to everything and many times location will be the determining factor in a buying decision.

Market Differently

Millenials are heavy online users. When building your marketing plan, think about using social media, websites and mobile technology to reach this audience. Baby boomers are increasingly online, but may be able to be reached in more traditional ways. For instance, word-of-mouth, relationships and newspaper advertising might be a way to target this group.

Be intentional about creating a marketing plan that targets these two very different groups and you will have the best shot at getting these groups interested in your home.

If you’re ready to sell or purchase a home, check out the Union Plus Real Estate Rewards program. You could get $500 for every $100,000 in home value if you use a real estate agent approved by SIRVA.*

*To qualify for cash back rewards (in cash back states), you must use a SIRVA-referred real estate agent. Program designed as a referral service to provide you the opportunity to select a real estate agent to meet your needs. You must evaluate the brokers, agents and their services and make selections and decisions based upon your best judgment, interest, priorities and concerns. Call 800-284-9756 or visit www.up-RealEstateRewards.com for important program details and state restrictions. Union Plus makes member feedback available. Union Plus does not endorse any User Content, or any opinion, recommendation, or advice expressed herein.

SIRVA is an independent provider of services. Union Plus is not affiliated with SIRVA and does not manage SIRVA or its programs. SIRVA is paying Union Plus for advertising services including dissemination of information about SIRVA and its programs to participating unions and their members as well as participation in Union Plus events and programs. No referral, recommendation, service representation or exclusivity requirement is intended by the Union Plus's mention or dissemination of the SIRVA name and delivery of this information to participating union members.

Different segments of homebuyers may have different needs. Identifying these differences can help you position your home to attract different kinds of homebuyers. Be sure to highlight these features that may make your home more appealing to different groups of homebuyers.

Should You Sell or Buy First?

Learn what happens in each instance, and how to coordinate your transition.

If you’re buying a home while selling your current house, there’s a good chance your closing dates won’t exactly align. How can you deal with selling your home before buying a new one, or vice versa?

Here Are Some Ideas:

If You Buy a Home Before Selling Your Current One:

The good news is you’ll immediately have a place to move into, but you may not have enough money saved for the down payment for the new ones. Some options:

- Tap into savings. Utilize money from savings or non-retirement investments, immediately replacing it once your home sells.

- Rent your existing home. Use the rent to go toward your old mortgage. With this option, you will still need money for the down payment of your new home.

- Add a sale and settlement contingency to your contract. This states you can’t close on the new house until the current house sells. If you come away with money from your home sale, you could put it toward your down payment.

If You Sell Your Home Before Buying a New One:

You’ll know how much you have for a down payment, and it may be easier to qualify for a new mortgage since you’re not carrying debt from your old home. But selling first means you may not have anywhere to live after closing. Some options:

- Stay with family or friends or rent an apartment.

- Rent-back agreement. You’d negotiate and pay rent to the new owners in order to stay in your home. However, there may be liability issues involved so you may want to discuss this option with an attorney.

Ready to buy or refinance a home? Contact the loan officers at the Union Plus Mortgage Company, a union-owned company for all your home financing needs.

The AFL-CIO, Union Privilege and a group of unions own Union Plus Mortgage Company and will benefit if you get your loan through the company. However, you are not required to use Union Plus Mortgage for your loan and are free to shop. For your Affiliated Business Arrangement Disclosure Statement, please visit https://www.unionplusmortgage.com.

Union Plus Mortgage Company has a services agreement with Union Privilege in which Union Privilege receives a financial benefit for providing agreed upon services.

The NMLS Consumer Access Website is: http://www.nmlsconsumeraccess.org. NMLS Number 1561829

![]()

You're in the market for a new home while actively trying to sell your current home, should you buy your new home first or wait until you sell your current home? Use these tips to help you have a smoother transition from your old home to your new home.

AFT School Bus Driver Using Free College to Strengthen Advocacy Skills

“I drive a 40-foot yellow hotbox on wheels,” says Sarah Cloud, a full-time contract school bus driver in Hurricane, Utah.

Cloud is a 20-year driving veteran. She loves kids and driving gives her the opportunity to interact with all kinds of students. She is a member of AFT Redrock 6032 and the Vice President of Transportation on the executive board.

“I work to increase our training and work on different aspects tied to challenges and needs drivers have,” Cloud says.

Outside of her job, she tends to her husband and her son, both of whom have a rare form of arthritis. Cloud is a prominent ambassador for the Arthritis Foundation and she has had to deftly navigate the medical establishment to ensure her family gets the care they need. It’s this latter role that ultimately attracted her to the Union Plus Free College Program.

“I was skimming a Union Plus email newsletter,” recalls Cloud. “I’ve been one of many moms out in the workforce for whom college was out of reach. I saw this offer, and I wondered if I could even do it. I decided to take a class and see if I liked it.”

The Union Plus Free College Program partners with AFSCME and Eastern Gateway Community College to offer online courses and degree programs with no out-of-pocket cost to active or retired union members and their eligible family members, including spouses, domestic partners, children (including stepchildren and children-in-law), dependents and grandchildren.

Cloud is studying to receive a Patient Navigator certificate.

“I’ve learned a lot about access issues,” she said. “Navigators improve disease outcomes. They help the individual and the public.”

Cloud continues, “I recommend this program to all union members I meet. Your family can go to school, and it’s huge.”

Outside of her job as a school bus driver, AFT member Sarah Cloud has long been an advocate for her husband and son, who both have a rare form of arthritis. She’s now enrolled in the Union Plus Free College Program and taking classes towards a Patient Navigator certificate to enhance her advocacy abilities.

Free College Program Gives Librarian’s Son Storybook Beginning

New Jersey CWA Member Cheryl Conselyea’s son, Ryan, is a plumber’s assistant. He tried traditional college, but the schedule didn’t work for him.

“When I got the Free College email from Union Plus, he was so excited. He was just like, ‘Wow, this is for me!’ He had about a week to apply,” Conselyea remembers.

Conselyea works as a supervising library assistant at Passaic County’s Clifton Public Library, a particularly busy branch.

“I love my staff and working with the public is great. We organized with CWA 12 years ago. They introduced us to Union Plus and all the special programs they provide,” she recalls.

The Union Plus Free College Program partners with AFSCME and Eastern Gateway Community College to offer online courses and degree programs with no out-of-pocket cost to active or retired union members and their eligible family members, including spouses, domestic partners, children (including stepchildren and children-in-law), financial dependents and grandchildren.

Conselyea says her son has had to pinch himself—he couldn’t believe that he could take classes for free and on his own time.

“Ryan is thriving,” Conselyea says. “The whole process for his enrollment was pretty seamless. His classes are so flexible, and most importantly, the program just calibrates right with his schedule.”

Ryan is pursuing his associate degree and hopes that learning about business will equip him as he gets deeper into his trade career and potentially starts his own venture.

“This Free College program is such an opportunity for adults and the children of union members to get a free education. I tell everyone I know about it,” says Conselyea.

CWA member Cheryl Conselyea was thrilled to discover that her son Ryan was eligible to enroll in the Union Plus Free College Program. Ryan has been able to take advantage of the program’s flexible schedule to take business classes while he continues working as a plumber’s assistant.